EUROMONEY says Cameroon still a high-risk option

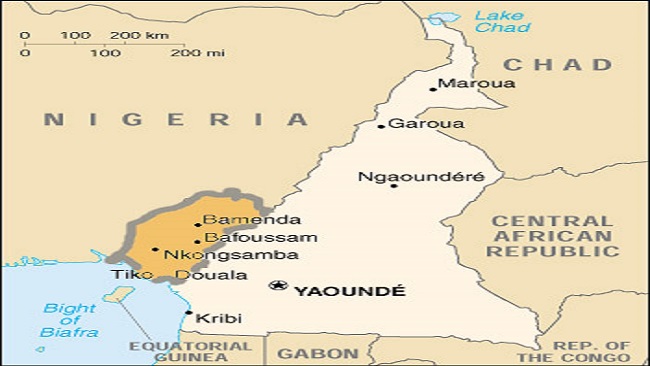

Cameroon finally held its repeatedly postponed legislative and municipal elections in February for the first time in seven years. It came amid the continuing swell of separatist fervour from the Anglophone community situated in the northwest and southwest regions bordering Nigeria. The elections took place without notable social upheaval, but have done little to usher in a calmer political environment. A partial boycott was spurred by the main opposition Movement for the Rebirth of Cameroon (MRC) – the party led by Maurice Kamto, who was living in exile until Thursday, when he returned to Cameroon. This invariably handed an easy victory to the Cameroon People’s Democratic Movement (RDPC) supporting the octogenarian president Paul Biya, despite the other large opposition party, the Social Democratic Front (SDF), participating.

Euromoney’s panel of experts is only too aware of the high risks associated with investing in Cameroon, which remains outside the top-100 sovereign borrowers, ranking a lowly 132nd out of 174 countries ranked in Euromoney’s survey. On a score of 34.7 out of a maximum 100 risk points (where a higher score implies safety), Cameroon is far riskier than neighbouring Gabon or Nigeria, and more in line with Gambia and Madagascar, while similar to Algeria and Ukraine in the crowd-sourcing survey:

One of Euromoney’s Cameroon contributors is Patrick-Nelson Essiane, an economist at the Bank of Central African States, and financial manager at the Initiative for Research and Analysis in Sustainable Development in Central Africa (IRADDAC). He brings to attention several political risks, including the constitutional council ordering the annulment of legislative elections in some parts of the southwest and northwest regions, where re-runs are expected in 20 to 40 days. He also notes that in mid-February an incident involving the army and secessionists resulted in the death of women and children in Ngarbuh (northwest region), highlighting the insecurity.

“The international community called for a deeper and independent investigation of this tragedy,” he says. “While between February 4 and 22, according to local media, 14 civilians and one of the military were killed by Boko Haram in the far north region, yet there were no special mentions of these incidents internationally.”

On top of that, three out of 10 regions have faced some instability recently, though with most of the violence occurring away from the biggest cities relatively close to the border with Nigeria.

Economic risk

However, on macro-fiscal metrics, Cameroon’s risks do appear to be slowly improving. That is the impression given by the IMF’s latest extended credit facility (ECF) programme review, showing accelerating GDP growth, the non-oil primary fiscal deficit narrowing and ample imports coverage. Cameroon can access the pool of regional forex reserves and also received a $76.1 million disbursement from the IMF in January, on completion of the fifth programme review, bringing the total up to $590 million.

If recent forecasts from the IMF, central bank and government are assessed as one, economic growth was around 3.3% in 2019, and could rise to around 4.5% in 2020, on the back of an increase in gas production, and decent prospects for manufacturing and telecommunications. “As economic activity in Cameroon is relatively well balanced geographically, the episodes of violence in the southwest, northwest and far north regions would have probably a moderated impact on the macroeconomic performance of Cameroon,” says Essiane. “In addition, the key industrial centre of Cameroon (Douala) is not fundamentally affected by the crisis, even if we see an increase of the workforce in this city due to migrations from the northwest and southwest regions.”

Yet Essiane admits there are some prominent risks to figure. “The northwest and southwest crisis has affected agriculture in these two regions since 2017, with a huge decrease of the Cameroon Development Corporation (CDC) production of banana, palm oil and rubber. “Informal food agricultural production also decreased, with farmers leaving their plantations, leading to an increase in food inflation in urban centres of the country.”

Oil

Moreover, last year, Sonara, the national oil refinery, suffered a fire, contributing to lower-than-projected tax revenue, constraining budget implementation. Treasury finances have become stretched by the government’s military expenses to address Boko Haram in the far north and the Anglophone crisis. Plus, Cameroon is acutely vulnerable to a global downturn caused by trade friction and/or the spread of the coronavirus disease (Covid-19), especially to any related falls in oil prices. The implications are non-trivial. For while Cameroon’s debt remains stable, there is “high risk of debt distress”, according to the IMF, with the debt servicing-to-exports ratio breaching the accepted threshold continuously until 2025, and significantly so until 2022. This is due, first, to the inclusion of Sonara’s maturing short-term liabilities and later because of a maturing Eurobond.

The IMF’s comprehensive debt sustainability analysis factors in various scenarios and indicates the debt load can be sustained and properly addressed. However, that assumes there are no shocks, including any undisclosed liabilities. There is nothing to suggest there might be, but the experience of Mozambique and Zambia should certainly temper the enthusiasm for investing in Cameroon.

Culled from Euromoney.com